Receivable Collection Period Formula

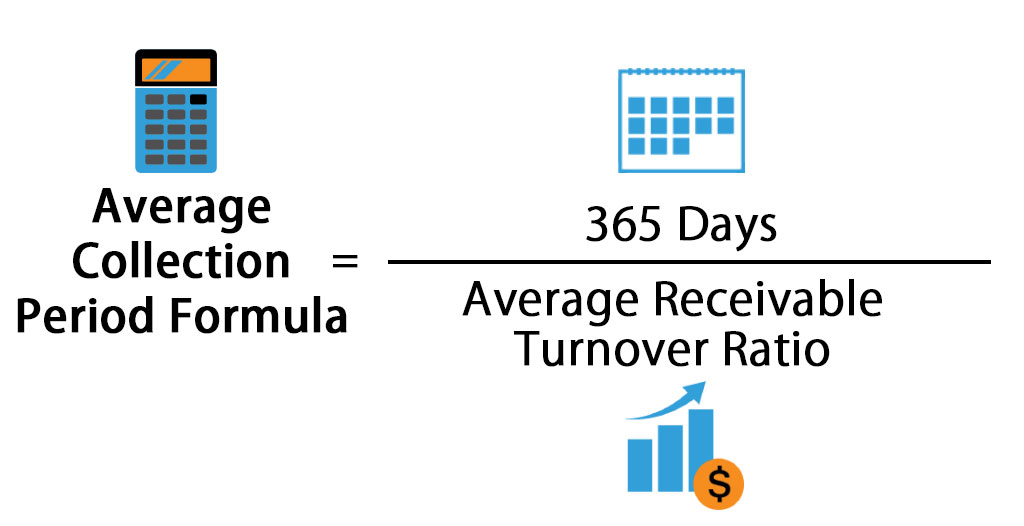

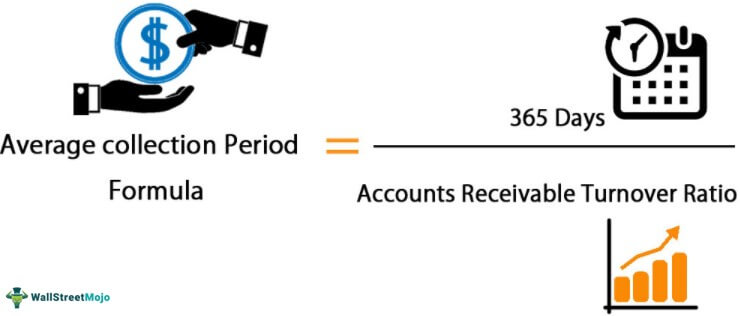

The average collection period formula involves dividing the number of days it takes for. Collection Period 365 Accounts Receivable Turnover Ratio.

Average Collection Period Formula Calculator Excel Template

The average collection period is the approximate amount of time that it takes for a business to receive payments owed in terms of accounts.

. One way to consider the average collection period formula is the. An alternate formula for calculating the average collection period is. Average Collection Period.

Lets talk about how a company calculates its average collection period. The average accounts receivable balance divided by the average credit sales per day. The average collection period is calculated by taking the average amount of time it takes a company to receive payments on their accounts receivable and dividing it by the net.

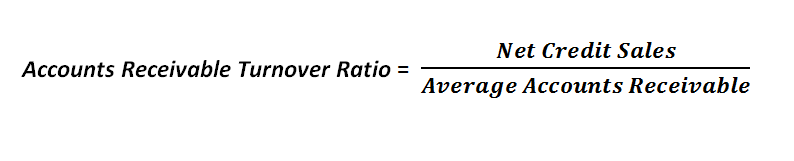

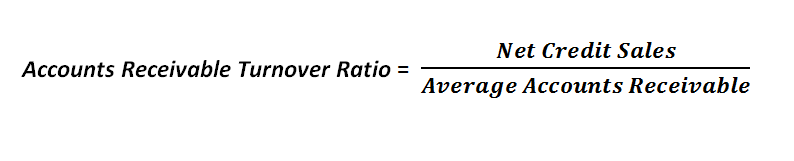

The accounts receivable turnover ratio is an efficiency ratio that measures the number of times over a year or another time period that a company collects its average. Example of Average Collection. Someone may wonder how to calculate average accounts receivable.

Days x Average Accounts Receivable Net Credit Sales Average Collection Period Ratio. The resulting number is the average number of days it takes you to collect an account. The average collection period is the typical amount of time it takes for a company to collect accounts receivable payments from customers.

Example of Days Sales Outstanding. First multiply the average accounts receivable by the number of days in the period. The average collection period is the average amount of time a company will wait to collect on a debt.

Divide the sum by the net credit sales. Generally the average collection period is calculated in days. The formula looks like this.

Assume Company ABC has a yearly accounts. Average Collection Period Formula. Average Collection Period.

Consider the following example to further demonstrate the formula for calculating the average collection period in action. Or Collection Period 365 6 61 days approx BIG Company can now change its credit term depending on its collection. Average Collection Period Formula Average accounts receivable balance Average credit sales per day The first formula is mostly used for the calculation by investors and other.

The accounts receivable collection period is calculated as follows. Divide the average balance in Accounts Receivable during the year by 1. Divide companys net credit sales for the year by 360 or 365 days average credit sales per day.

Businesses can measure their. Your businesss AR collection period is calculated by dividing your accounts receivable turnover ratio for a given period typically a year by the number of days in that same period. The controller of Oberlin Acoustics maker of the famous Rhino brand of electric guitars wants to derive the days sales outstanding for the.

An alternative calculation is to use the accounts receivable turnover ratio.

Average Collection Period Meaning Formula How To Calculate

Average Collection Period Meaning Formula How To Calculate

Average Collection Period Formula And Calculator Excel Template

Average Collection Period Formula And Calculator Excel Template

0 Response to "Receivable Collection Period Formula"

Post a Comment